Income Taxation of Special Needs Trusts, Part 2

In your future planning for your child with special needs, remember to consider income taxation of special needs trusts, including Qualified Disability Trusts (QDTs). If you set up a special needs trust (“SNT”) with another law firm, the attorneys may not have...

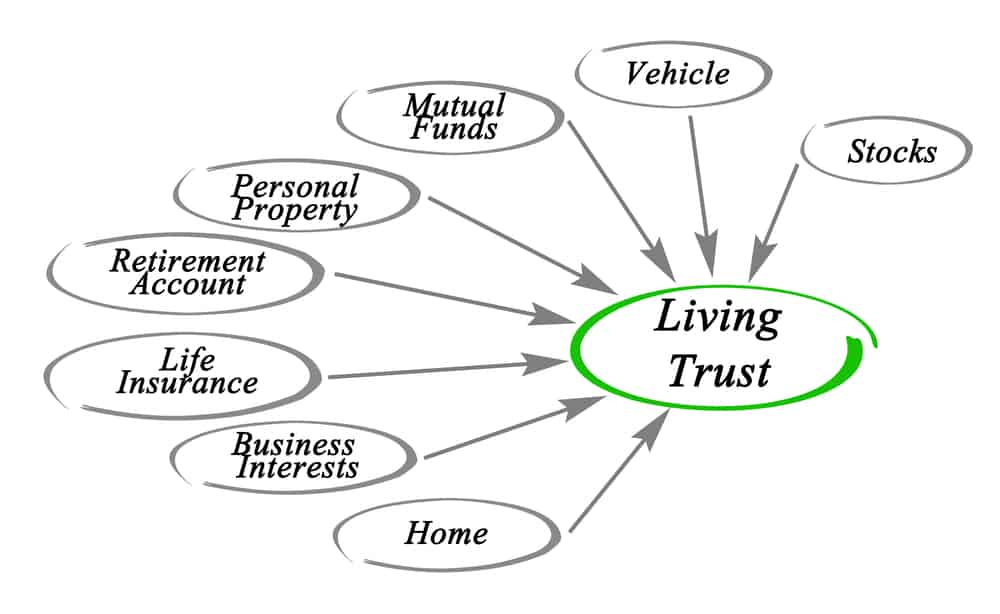

Trusts: The Basics

People just beginning their future planning may hear many terms thrown around by their relatives and attorneys: trust, beneficiary, settlor, and more. For those unfamiliar with trusts, the many different words used to describe them can be quite confusing. This article...

What Is a Guardian Ad Litem?

A guardian ad litem, or guardian “for the suit”, can be appointed by the court before a guardianship hearing to act in the guardianship proceeding. The court can appoint a guardian ad litem to report to the judge about the person with special needs’ best interests....