Blog

Pros and Cons of ABLE Accounts for Your Child with Special Needs

The Achieving a Better Life Experience (ABLE) Act is a federal law that allows some people with disabilities or their family members to establish a tax-free savings account for their financial needs. Recent federal legislation, including the ABLE Adjustment Act and...

ABLE Account Changes Become Permanent

The Achieving Better Life Experience (ABLE) Act, which Congress passed in 2014, is designed to allow persons with disabilities to save funds for future needs in a tax-advantaged account while still maintaining their eligibility for certain means-tested public benefits...

Long-Term Care Options for Adult Children with Special Needs

As children with special needs age, parents increasingly need to consider their future care needs, which include developing a long-term care plan. Examining long-term care options for adult children with special needs is crucial to protecting their future when parents...

Feds Withdraw Efforts to Prohibit Paying Individuals with Disabilities Less than Minimum Wage

The U.S. Department of Labor (DOL) recently withdrew its Notice of Proposed Rulemaking that would have phased out the payment of subminimum wages to workers with disabilities. In its withdrawal notice, the DOL justified its decision by noting the more than 17,000...

Special Needs Planning for the Blended Family

The traditional nuclear family is largely a thing of the past. Blended families, in which one or both spouses have children from previous relationships, are an increasingly common phenomenon. "Nontraditional" families, including blended families, now outnumber...

Puns Summer Selection

The Illinois Department of Human Services (DHS) has announced that in July 2025, the PUNS Unit of its Division of Developmental Disabilities (DDD) selected every eligible adult who has been waiting to apply for Developmental Disability (DD) waiver services for more...

Guardianships and Powers of Attorney: What Parents of Children with Special Needs Should Know

Power of attorney and guardianship are two types of legal tools that parents of children with special needs may wish to utilize when their children become legal adults. Parents of children with special needs typically are accustomed to handling their medical,...

Social Security Returns Overpayment Recovery Rate to 100%

The Social Security Administration (SSA) has announced that it will return to its previous policy of a 100% overpayment recovery rate. In other words, if SSA discovers that a Social Security beneficiary has been overpaid, it will retain 100% of the beneficiary’s...

Will a Personal Injury Settlement or Award Endanger Government Benefits for My Child with Special Needs?

Individuals with special needs often receive government benefits to assist them with medical and living expenses. However, these crucial benefits are typically needs-based. As a result, a sudden influx of income – such as a personal injury settlement or award - can...

DOJ Launches Investigation into Illinois Department of Human Services Division of Developmental Disabilities; Administration for Community Living to Close

The U.S. Department of Justice (DOJ) has advised the Illinois Department of Human Services (IDHS) Division of Developmental Disabilities by letter that it is launching an investigation into the agency’s treatment of people with developmental disabilities. Illinois has...

Comparing Special Needs Trusts with ABLE Accounts

Special needs trusts and ABLE accounts are useful saving tools to save much-needed funds for children with special needs. Although their requirements vary, these tools allow these individuals to shelter savings without endangering their eligibility for means-tested...

HB 1337 Would Limit Waivers Signed by Parents of Children with Disabilities

Special education advocates from organizations such as Equip for Equality, Access Living, and Legal Council for Health Justice are pushing the Illinois General Assembly to pass House Bill (HB) 2337 to protect the educational rights of children with disabilities....

The Exceptional Family Member Program: Assistance for Military Family Members with Disabilities

Military families who have a family member with special needs may be able to enroll them in the Exceptional Family Member Program (EFMP), which provides support and management for their care and services. EFMP is a U.S. Department of Defense program available to...

Can I Make a Special Needs Trust the Beneficiary of My IRA? What About a Life Insurance Policy?

A special needs trust is a way for families to financially support their family members with special needs without endangering their eligibility for needs-based government benefits like Medicaid and SSI. Many families in this situation set up a special needs trust as...

Think Differently Database Act Now in Effect

President Joe Biden signed the Think Differently Database Act into law a few weeks before leaving office. The law aims to establish an online database to gather and publicize resources for people with disabilities, their families, and caregivers. The Secretary for the...

Congress Extends Autism CARES Act and Think Differently Database Act, but Funding Remains Uncertain

Former President Joe Biden signed a five-year extension of the Autism Collaboration, Accountability, Research, Education and Support Act (Autism CARES Act) in late December 2024. The move came just days after the Autism CARES Act expired. Autism CARES Act The Autism...

Dignity in Pay Act Now in Effect for Workers with Disabilities

The Dignity in Pay Act became effective in Illinois on January 1, 2025. Under the Act, the Illinois Department of Human Services (IDHS), the Illinois Council on Developmental Disabilities (ICDD), and the Illinois Department of Labor must implement a five-year process...

Coalition of States Asks Court to Declare Section 504 of the Rehabilitation Act Unconstitutional

In 1974, the Rehabilitation Act of 1973 became law. Congress has passed various amendments to the Rehabilitation Act over the years, including the amendments contained within the Americans with Disabilities Act (ADA). One portion of the Rehabilitation Act particularly...

National Council on Disability Issues Annual Progress Report

The National Council on Disability (NCD) has released its annual progress report for 2024. In this report, NCD summarizes developments in disability policy that have occurred over the last year. NCD also points out several areas of progress in the report and makes...

When Does the Guardianship of an Adult with Special Needs End?

If you are thinking about getting guardianship of your adult child with special needs, consider whether and when you may want to terminate that guardianship in the future. Since ending the guardianship can be difficult, you should fully understand how the process...

HB 0793 Increases Personal Needs Allowance, Heads to Governor for Signature

The Illinois legislature has passed HB 0793 and Gov. JB Pritzker has signed it into law. The bill amends various laws affecting human services and some persons with disabilities. Notably, HB 0793 amends the Medical Assistance Article of the Illinois Public Aid Code...

Social Security Administration No Longer Includes Food Assistance from Third Parties in ISM Calculations

Earlier this year, the Social Security Administration (SSA) published a final rule entitled “Omitting Food from In-Kind Support and Maintenance (ISM) Calculations.” The final rule went into effect on September 30, 2024. Overall, the rule will likely make more people...

IRS Increases ABLE Account Contributions for 2025

The Internal Revenue Service (IRS) has issued Notice 2024-40, which adjusts various tax-related figures annually for inflation. These adjustments, which take effect on January 1, 2025, include the limits on contributions to ABLE accounts for 2025. The amount of money...

CMS Issues Guidance on Medicaid’s Early and Periodic Screening, Diagnostic, and Treatment Requirements, Behavioral Health Coverage

The Centers for Medicare & Medicaid Services (CMS), a division of the U.S. Department of Health and Human Services (HHS), recently issued SHO #24-005 – Best Practices for Adhering to Early and Periodic Screening, Diagnostic, and Treatment (EPSDT) Requirements....

The SECURE Act, SECURE 2.0, and the 2024 IRS Regulations: How this Legislation Affects Special Needs Trusts

The SECURE Act, SECURE 2.0, and recently released regulations interpreting this legislation have significantly impacted retirement planning, especially as it relates to special needs trusts, which are designed for individuals with disabilities. The changes that these...

Bipartisan ENABLE Act Would Extend Expiring Provisions of the ABLE Program

U.S. Senators Bob Casey (D-PA) and Eric Schmitt (R-MO) introduced the Ensuring Nationwide Access to a Better Life Experience (ENABLE) Act earlier this year. As of September 20, 2024, the bill has unanimously passed the Senate. What to Know About The Enable Act The...

Voting Rights and Adults with Special Needs

Voting is one of the most fundamental rights that Americans enjoy. States largely determine voting rights, so individuals with special needs who can vote in one state may be unable to vote in another. Eligibility Requirements for Voting Many states have laws that...

Housing Options for Adult Children with Special Needs

Many children with special needs remain in a parent's home after they become adults, with their parents continuing to be their primary caregivers. However, as children get older, their need for independence may change, as well as their housing options. Supplemental...

Individual Rights for My Adult Child with Special Needs: Driving, Voting, Medical Decisions, and More

Individual rights that we generally take for granted as Americans may be limited or restricted in some ways when it comes to an adult child with special needs. Therefore, as children with special needs become adults, some of their rights may be limited under state or...

What is the Difference Between a Pooled Special Needs Trust and an Individual Special Needs Trust?

All special needs trusts aim to allow individuals with special needs to save money for future needs while still maintaining their eligibility for government benefits like SSI and Medicaid. However, significant differences exist between pooled special needs trusts and...

HHS Issues Final Rule Strengthening Protections Against Disability Discrimination Under Section 504

The U.S. Department of Health and Human Services (HHS) has issued a final rule entitled “Nondiscrimination on the Basis of Disability in Programs or Activities Receiving Federal Financial Assistance.” The rule's purpose is to update, clarify, and strengthen the...

IEPs and Your Child with Special Needs

Although Rubin Law does not currently provide legal representation in special education matters, we recognize that many of our clients have children who have or will have individualized education plans (IEPs) at some point in the future. As a result, we are providing...

Service Animals and Individuals with Disabilities

Under the Americans with Disabilities Act (ADA), a “service animals” are dogs* with individual training to do work or perform tasks for a person with a disability. The ADA does not require that service animals be certified by a particular entity or wear identifying...

What is Supported Decision-Making Under Illinois Law?

The Illinois Supported Decision-Making Agreement Act (SDMA) went into effect on February 27, 2022. The purpose of the SDMA is to provide a less restrictive alternative to guardianship for adults who have intellectual and developmental disabilities. The SDMA allows...

DOJ Issues Final Rule Updating ADA as to Accessibility of Web Content and Mobile Apps Provided State and Local Governments

The U.S. Department of Justice (DOJ), Civil Rights Division, published a final rule in the Federal Register on April 24, 2024, updating its Title II regulations for the Americans with Disabilities Act (ADA). The purpose of the rule is to establish certain requirements...

Social Security Changes Rules on Recouping Benefit Overpayments

The Social Security Administration (SSA) has announced that it will change how it collects past benefit overpayments to Social Security recipients. SSA's previous overpayment policies have left many Americans with disabilities in dire financial circumstances. SSA...

Does In-Kind Support and Maintenance from Family Members Affect Eligibility for SSI Benefits for My Adult Child with Special Needs?

In-kind support and maintenance can be beneficial, but it must be handled carefully. When family members live with individuals with special needs or provide them with certain forms of financial support, like food or housing, the eligibility of these individuals for...

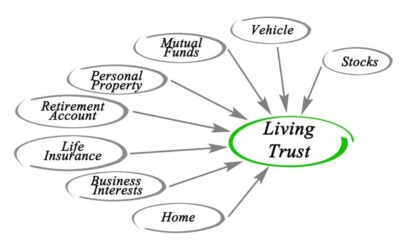

What Can I Use to Fund a Special Needs Trust for My Child?

A special needs trust is a common way for parents to prepare for the future care of a child with special needs. The child can use the proceeds from a special needs trust to pay for certain purchases and services that government benefits won’t cover, such as...

HUD Regulations Effective January 1, 2024, Exclude Special Needs Trusts Proceeds from Income for Purposes of Low-Income Housing

The Housing Opportunity through Modernization Act (HOTMA) became law in January 2016. However, final regulations to implement certain sections of the law are now going into effect. The final rule to implement Sections 102, 103, and 104 of HOTMA took effect on January...

Power of Attorney or Guardianship: Which is Appropriate for My Adult Child with Special Needs?

Understanding the difference between a power of attorney and a guardianship is critical. When children with special needs approach age 18, parents must realize that they will soon become adults, at least as far as the law is concerned. Once your child with special...

U.S. Department of Education Releases Guidance on Assistive Technology Devices and Services for Children with Disabilities Under IDEA

As the parent of a child with special needs, you know how important it is to advocate for your child’s education. The Individuals with Disabilities Education Act (IDEA) is an instrumental piece of legislation that helps protect the rights of children with special...

Senate Bill 188 Closes Loophole Permitting Parental Access to Children’s Healthcare Records

As the parent of a child with special needs, you must access your child's healthcare records for various reasons. You may need access to medical records to manage your child's medical needs or seek out new healthcare providers. You may need those records to submit or...

Should I Leave My Estate to the Sibling of My Child with Special Needs? Should the Sibling Be Named as the Child’s Guardian When I Am No Longer Able to Serve as Guardian?

When you have a child with special needs, your estate planning may look significantly different. Many parents traditionally leave their estate to their children in equal shares. Parents also routinely designate a guardian for their children if they pass away while the...

How Different Types of Insurance May Assist Your Child with Special Needs

As the parent of a child with special needs, you must plan not only for your financial future but also for that of your child. That plan may include the use of various forms of insurance. While you may plan to care for and financially support your child with special...

Qualified Disability Trust Exemption Increases to $5,050 in 2024

A qualified disability trust (QDT) is a type of trust that qualifies for a specific federal tax exemption and is designed to benefit an individual with special needs. Most special needs trusts qualify as QDTs. The amount of this federal tax exemption changes over...

ABLE Account Contribution Limit to $18,000 Per Year in 2024

In 2014, Congress passed the Achieving a Better Life Experience (ABLE) Act, which authorizes individuals with special needs to establish ABLE accounts or special savings accounts. Before the ABLE account, these individuals often could only have significant savings by...

When Your Child with Special Needs Becomes an Adult: Is Guardianship Really Necessary, or Is an Alternative Enough?

Guardianship matters can be complicated. When parents care for a minor child with special needs, their legal authority to make decisions on the child's behalf is unquestionable. The much more difficult questions come when that child turns 18 and becomes an adult, at...

Is a Pooled Special Needs Trust Right for My Child?

It is important to understand the benefits of pooled special needs trusts. Parents of children with special needs often want to set aside funds to provide for them in the future. Grandparents and other relatives also may want to leave inheritances to the children....

What Are Resource Limits for Public Benefit and How Do They Affect Benefits Eligibility for My Adult Child with Special Needs?

As children with special needs become adults, they often rely on various public benefits to assist them with medical care, financial support, and other forms of care. These public benefits programs may include Supplemental Security Income (SSI) and Medicaid. However,...

College Assistance for Young Adults with Disabilities

As children with special needs complete high school and become adults, parents may be looking for additional educational opportunities for them. Fortunately, your family may be able to take advantage of some forms of assistance that may enable, support, and assist...

Why Do I Need a Special Needs Trust Attorney?

When you engage in estate planning, a major goal is often to provide for your children after you are gone. If you have a child with special needs, you understand that your child may need financial support for the rest of their life. Additionally, a child who needs...

Powers of Attorney and Your Child with Special Needs

Powers of attorney are critical to have when you have an older child with special needs. If you are the parent of a child with special needs, you likely have grown accustomed to making medical, educational, and legal decisions on behalf of your child as a minor. When...

Understanding Medicaid HCBS Waivers for Adults with Special Needs

Home and Community-Based Services (HCBS) waivers are programs that offer services designed to permit individuals to remain in their own homes or communities rather than in institutions. Illinois waivers address different services for individuals with similar levels of...

Medicaid Estate Recovery: What Kinds of Accounts and Assets Will the Government Seek “Pay Back” From After My Loved One with Special Needs Passes Away?

Under current law, Illinois generally must pursue Medicaid estate recovery from the estates of Medicaid recipients. As a result, when the Medicaid beneficiary passes away, the state of Illinois typically will pursue the beneficiary's assets for repayment of the...

Illinois Medicaid Asset Limit Increases from $2,000 to $17,500

Generally, Medicaid or Aid to the Aged, Blind, and Disabled (AABD) is a state-sponsored medical insurance program for certain individuals with disabilities based on financial need. One major benefit to Medicaid is that it covers long-term care costs including group...

What Type of Attorney Handles Special Needs Trusts?

Families with children who have special needs often must make significant decisions throughout their lifetimes. One such decision involves choosing a qualified attorney to assist them with their special needs planning for their child, which often includes creating...

Financial Resources for Parents of Children with Special Needs

Supporting children with special needs typically goes far beyond age 18 and often is a lifelong commitment. Children with special needs may also have more financial needs than other children, especially if they have complex medical problems or require a high level of...

Issues to Consider When Your Child with Special Needs Turns 22

If you have a child over the age of 18 who is currently receiving special education services, you likely had to make some important decisions and changes as your child turned 18 and became a legal adult. However, turning age 22 also has some important consequences for...

How to Fund a Special Needs Trust

A special needs trust is often the best way for parents to plan for the future care of a child. The proceeds of a special needs trust can help pay for items and services that government assistance doesn’t cover, like transportation, computer equipment, and...

Children’s Waiver Under the PUNS

Illinois Prioritization for Urgency of Need for Services or PUNS is a database of individuals registered for Developmental Disability Waiver services funded by the Illinois Department of Human Services, Division of Developmental Disabilities (DDD). These services...

Duties of the Trustee of a Special Needs Trust

Many parents who have a child with special needs establish a special needs trust to plan for their future. The proceeds of a special needs trust can help pay for things for that child that government assistance doesn’t cover, such as transportation and education, as...

Who Should Be the Trustee of My Child’s Special Needs Trust?

A Third Party Special Needs Trust is a common mechanism that parents use as a repository for any inheritance their child with special needs will receive after their death or for gifts from another family member. By creating a special needs trust, they can ensure that...

Legal Duties of Guardians of Adults with Special Needs in Illinois

The legal duties of guardians of adults with special needs under Illinois law largely depend on the type and scope of the guardianship order that the court grants. For example, the court can limit the guardian's powers in the guardianship order or allow the guardian...

ABLE Age Adjustment Act included in Omnibus Spending Bill

When President Biden signed the Consolidated Appropriations Act of 2023 spending bill into law at the end of the 2022 legislative session, it included an important update to the Achieving a Better Life Experience (ABLE) Act, or the ABLE Age Adjustment Act. At Rubin...

How Should My Estate Plan Be Different if I Have a Child with Special Needs?

An estate plan for children with special needs requires careful and mindful planning. Parents of children with special needs provide critical support for their children, not only as their loving parents but also as their advocates, protectors, and financial support....

Special Needs Trust Improvement Act Signed into Law

The Special Needs Trust (SNT) Improvement Act of 2022 is now in effect after being signed into law as part of the much larger Consolidated Appropriations Act of 2023. It amends The Secure Act of 2019. The Special Needs Alliance, a national advocacy group of which...

Contributing to an ABLE Account When an Individual with Special Needs is Working

Many individuals with special needs must necessarily rely on public assistance and government benefits to help pay for their often-significant expenses. Although family members and friends may be willing and able to help defray the costs of those expenses, doing so...

How Does a Guardianship Affect the Ability of an Individual with Special Needs to Hold a Driver’s License?

Some individuals with special needs may hold a driver’s license, and others may not, depending on the severity of their special needs and their ability to safely operate a motor vehicle. Furthermore, whether a legal guardianship exists for a person with special needs...

The Role of the Guardian Ad Litem in Guardianship Proceedings

Guardian ad litem is a term you have likely heard, but may not understand what it means or their role. When adults with special needs turn 18, they legally become adults. As a result, their parents' legal rights to make decisions for their child ends, as the law...

Working When an Adult with Special Needs Receives SSI or Social Security Disability Benefits

When an adult with special needs receives any Social Security benefits, earning wages from working could affect those benefits. However, the impact that working can have on Social Security benefits depends largely on what type of benefits the adult receives and the...

Supported Housing Options for Adult Children with Special Needs

Many families choose to care for their adult children with special needs at home. However, as parents age, adult children become more independent, or their needs change, families may reassess their housing arrangements. Various supported housing options for adult...

SSI Recipients to See Significant Increase in 2023 Benefits

One common source of income for individuals with special needs, both as children and as adults, is Supplemental Security Income (SSI). This federal means-tested benefits program provides monthly cash assistance for individuals who are disabled and unable to work. As a...

What Happens to Public Benefits Eligibility if Your Child with Special Needs Marries?

Some adults with special needs eventually choose to marry. When this happens, you may be concerned about the impact of your adult child’s marriage on their ability to continue to receive public benefits. When your adult child with special needs relies on Social...

5 Issues to Consider Before Your Child with Special Needs Turns 18

As the parent of a child with special needs, your role as a parent becomes different when your child becomes a legal adult. Although your child may have some or all the same needs for assistance from you, your legal relationship with your child changes when your child...

Testamentary v. Free-Standing Special Needs Trusts

Adding a child with special needs to your family can bring change and uncertainty to your life. You may contemplate what the future holds for your child and how to best plan for your child's future. While you can never anticipate every need or contingency that your...

I Have a Special Needs Trust for My Child. How Can I Use These Funds for My Child Without Affecting His Public Benefits?

Parents most commonly establish special needs trusts for their children to provide financial support for them while not jeopardizing their eligibility for necessary public benefits. A special needs trust attorney can assist the parents in setting up the trust or other...

How Will My Divorce Affect My Child with Special Needs?

Divorce in the United States today is common, and some studies suggest that parents of children with special needs may have even higher rates of divorce than other married couples. The personal, medical, and financial challenges that often accompany a child with...

New State Law Requires Training for Newly Appointed Guardians in Cook County

Becoming guardians over the persons and/or estates of individuals with disabilities is an enormous responsibility. Over the years, the Illinois legislature has increasingly required various safeguards to ensure that guardians receive the training and education needed...

Reporting Requirements: What Your Adult Child with Special Needs Must Report When Receiving Social Security Benefits

Many adult children with special needs receive Social Security benefits. Furthermore, many parents of adult children with special needs serve as their children’s guardians, powers of attorney, and/or representative payees for Social Security benefits. As a result,...

Changes to the Illinois Power of Attorney Act and Health Care Powers of Attorney for Adults with Special Needs

Powers of attorney are important legal documents. Many adults with special needs can make decisions about their medical care and actively participate in their health care plans. However, there may come a time when they no longer have the capacity to make those...

What is a Letter of Intent? Do I Need One for My Child Who Has Special Needs?

A letter of intent is a future planning document that a parent can prepare for a child with special needs. The goal of a letter of intent is to assist your loved ones and those who will be caring for your child when you no longer can act as the child’s primary...

Taxes and Special Needs Trusts: What You Need to Know

Special needs trusts are an excellent way to provide additional financial support for a child with special needs without endangering eligibility for means-tested government benefits. However, these trusts do have potential tax implications, both for the trust itself...

Should I File for Guardianship of My Child When He Turns 18 if He Has Special Needs?

Filing guardianship of your child with special needs when he turns 18 may or may not be necessary, depending on your situation. In some cases, getting guardianship is necessary because your adult child does not have the capacity to make financial and personal care...

Can I Pursue a Claim for Medical Malpractice that Caused My Child’s Disability? How Long Do I Have to File a Claim? How Can Rubin Law Help Me?

In some cases, a child’s permanent disability may result from a medical error or a failure of a medical professional to exercise a reasonable standard of care. When this situation occurs, the parents or guardians of the child may have a legal claim for medical...

Are Illinois ABLE Accounts Subject to Medicaid Recovery or Clawback? Conflicting Guidance from the State and Federal Governments

Historically, the state of Illinois, like many states, implemented a "payback" or "clawback" provision that allowed it to seek reimbursement from ABLE accounts after a beneficiary’s death. The state could seize any remaining funds in ABLE accounts to pay for the costs...

How Can My Adult Child Continue to Receive Child Support from a Parent Without Jeopardizing Their Medicaid and SSI Eligibility?

Under Illinois law, children may have a right to receive child support from one or both parents after they reach adulthood if they are disabled. However, they also may be eligible to receive Medicaid and Supplemental Security Income (SSI), which have strict income and...

How Social Security Evaluates A Trust As A Countable Resource

A person’s resources affect the ability to qualify for crucial government benefits. The Social Security Administration (SSA) sets forth resource limits for SSI applicants and recipients. For example, to qualify for Supplemental Security Income (SSI),...

How The SECURE Act Affects Special Needs Planning – The Eligible Designated Beneficiary

The Setting Every Community Up for Retirement Enhancement (SECURE) Act went into effect on January 1, 2020. The SECURE Act affects special needs planning, in particular, inherited IRAs owned by third-party special needs trusts. Historically, these types of trusts...

Qualifying For Disability Benefits As An Adult

Social Security benefits are available through the Social Security Disability Insurance (SSDI) program to people who cannot work because they have a medical condition expected to last at least one year or result in death. Adults must meet a very rigid definition of...

What Is A Pooled Trust?

Beneficiaries of government programs such as Supplemental Security Income (SSI) and Medicaid must have limited income to qualify for these benefits. They may lose these crucial benefits if they receive an inheritance, an accident settlement, or simply accumulate too...

I’ve Established A Third Party Special Needs Trust, What’s Next?

Establishing a third-party special needs trust is a major step in providing for the needs of an individual with disabilities. Special needs trusts are complex and may be difficult to understand and administer. Once the trust documents have been signed, the trust has...

What Expenses Can A Special Needs Trust Pay?

The purpose of a third party special needs trust is to provide persons with disabilities the means to augment their quality of life while enabling them to remain eligible for needs-based public benefits. While a special needs trust is a valuable tool for...

Accounting Of Special Needs Trusts

Accounting for special needs trusts is not much different than accounting for other types of trusts. A trustee has a legal obligation to account for certain trust activities to beneficiaries and other interested parties. The trustee must adhere to federal tax law and...

Social Security Recipients to Pocket 5.9% Benefit Increase

Recently, the federal government announced the cost-of-living adjustment (COLA) for 2022. This adjustment is applied to federal benefits to be disbursed in 2022. Many analysts expected that the COLA would be the highest since 1983 when it was 7.4 percent. The single...

Understanding Eligibility Rules for Means-Tested Programs, Part Two

The second part of this blog will discuss the way that income is characterized for a means-tested entitlement program and how it affects a benefit award. The federal Supplemental Security Income (SSI) program rules distinguish between and characterize income in...

Understanding Eligibility Rules for Means-Tested Programs, Part One

Eligibility rules for many critical essential entitlements are means-based. Thus, any income and assets received by an individual with disabilities will affect the benefit awards that they potentially receive from these types of entitlement programs. Therefore, the...

Distinguishing the Different Types of Special Needs Trusts – Third-Party Special Needs Trusts

The two entirely different types of trusts that are usually referred to as “special needs” trusts are treated differently for tax purposes, benefit determinations, and court intervention. We already discussed Self-Settled Special Needs Trusts in our prior blog post....

Distinguishing the Different Types of Special Needs Trusts – Self-Settled Special Needs Trusts

Greater awareness of disabilities in the last few decades has caused many of us to appreciate the need for special needs trusts. In most cases, the primary, essential purpose of a special needs trust is to improve the quality of life of an individual with special...

Some Important Issues To Consider When Creating A Special Needs Trust

A child with special needs changes the life of a family in many ways. The parents of a child with special needs embark on an unplanned journey knowing little of what the future holds for their child. Planning for an unknown future without any knowledge or experience...

State Increasing Funding For I/DD Community

After a federal judge admonished the State of Illinois in 2017 for failing to meet the requirements of a 2011 consent decree requiring more community-based services for the intellectually and developmentally disabled (I/DD) community, Governor J.B. Pritzker has...

Guardianship for Individuals With Disabilities

In Illinois, a parent is also considered the legal guardian of his or her child until the child turns 18. Guardians have the legal right to make important decisions for a child such as choosing medical care and handling financial situations. Professionals like school...

The Work Without Worry Act Explained

On June 17, 2021, the United States Senate Committee on Finance passed a bipartisan bill called the Work Without Worry Act. The goal is to protect Americans with disabilities who receive Social Security benefits and also want to work. Under the Act, individuals with...

Medicaid Waiver Services and the Possible Pending Federal Legislation Impacts

Federal Medicaid offers certain waivers for people with special needs or chronic health concerns. With these Medicaid waivers, healthcare providers can care for someone in their home as opposed to only providing services in long-term care facilities. Each state can...

IRAs and Third Party Special Needs Trusts

There are many ways to provide for your family member with special needs after you are gone. One of your largest assets may be a hard-earned retirement fund. Since most Individual Retirement Accounts (IRAs) are made up of pre-tax money, future taxable...

Understanding Substantial Gainful Activity and What Happens if You Exceed It

If you are receiving Social Security disability insurance (SSDI) you may be concerned about losing your benefits if you take a job and earn income. The Social Security Administration has created special rules to encourage some people who want to try to work, even...

Illinois’ Health Benefits for Workers with Disabilities (HBWD) Program

In January 2002, Illinois launched a program called Health Benefits for Workers with Disabilities (HBWD). The program’s main goal is to assist people with disabilities who want to work but are afraid they will lose Medicaid coverage. For many potential workers...

My Child With Disabilities is Turning 18, What Steps do I Need to Consider?

In the United States, when a child turns 18 they become an adult who is legally responsible for their choices and actions and parents lose the ability to make decisions for their adult child. However, the law provides exceptions for persons who have disabilities that...

My Child is on Government Benefits and Received a Stimulus Check, What Do I Do?

The third round of government stimulus payments has been authorized by President Biden’s American Rescue Plan Act of 2021. Importantly, adults with disabilities who are dependents for tax purposes are now eligible to receive a stimulus payment. If you have a dependent...

ABLE Accounts: Understanding the Basics and Allowable Uses

If you have a family member with special needs, you should consider creating an ABLE account as a powerful tool to help provide for his or her financial future. Since many government benefit programs for individuals with special needs are based on a means-tested...

How the SECURE Act Interacts With Special Needs Trusts

At the end of 2019, the Setting Every Community Up for Retirement Enhancement Act, (the SECURE Act) was signed into law. The overall objective was to improve access to retirement accounts such as IRAs and 401(k)s to ensure older Americans don’t outlive their...

Downstate Illinois Police Pension Benefits: Providing For A Beneficiary With Special Needs

In Illinois, the police officers who serve and protect the citizens of their communities face challenging situations and sometimes life-threatening circumstances every day. These brave men and women deserve a good retirement as a result of their dedication. Article 3...

How Downstate Illinois Fire Pension Benefits Can Help a Person With Special Needs

Firefighters hold a special place in our hearts for their courage and the sacrifice they make every time they respond to a call. Their selflessness carries over to their family and community and the team at Rubin Law is proud to represent firefighter families who have...

State University Retirement System (SURS) Pension Requirements for Beneficiaries With Special Needs

This article is for State University Retirement System (SURS) participants who want to learn how to use their SURS retirement benefits to provide for a loved one with special needs. While it may seem like a simple process, ensuring that your child with special needs...

How To Ensure Your State Employees Retirement System (SERS) Pension Will Benefit Someone With Special Needs

Employees who perform services for the State of Illinois are eligible for retirement benefits under the State Employees Retirement System (SERS). Participants in the SERS program receive pension payments upon retirement and can name beneficiaries who will receive...

Your Teachers’ Retirement System Pension (TRS) Can Provide Benefits For Individuals With Special Needs

The Illinois Teachers’ Retirement System (TRS) provides retirement benefits for workers in the educational system including: classroom teachers, regional superintendents school administrators school nurses, social workers, and psychologists school librarians other...

Using Your Illinois Municipal Retirement Fund (IMRF) Pension For Your Loved One With Special Needs

The Illinois Municipal Retirement Fund (IMRF) offers benefits for certain Illinois workers. Since retirement funds’ rules and benefits can vary, it’s important to understand how you can use retirement funds to provide for your child with special needs. In this...

How An Individual With Special Needs May Obtain A Driver’s License, And How Guardianship Can Affect It

Some people with disabilities may be able to drive a motor vehicle and hold a valid driver’s license. Depending on their specific abilities and whether accommodations are available to address any challenges, they can apply for a license if they can pass all required...

Helpful Resources For Individuals With Intellectual And Developmental Disabilities

At Rubin Law, our law practice is exclusively limited to helping our fellow Illinois families of children and adults with disabilities. As a result of this and our own personal experiences, we know how crucial organizations can be in making life a little easier and in...

6 Planning Issues to Consider Before Your Child With Special Needs Turns 18

Parents of children with special needs face many challenging situations every day. Sometimes it is difficult to think about your child’s care tomorrow, let alone in a few years. At age 18, children become legal adults, but your child may need continued care well after...

The Basics of Applying for SSI Disability Benefits for Your Child

Supplemental Security Income (SSI) is an important government benefit for children with special needs. However, dealing with the government can be confusing, time-consuming, and frustrating. Before beginning the application process, you should have a solid...

Understanding Some Basic Terms Involved in Special Needs Care and Planning – Part II

At Rubin Law, we limit our practice to the areas of Estate Planning, Guardianship, and Probate for families of children with special needs and adults with special needs. With our laser focus, we thoroughly understand the complexities of the various benefit systems and...

How Pandemic Restrictions are Affecting Children With Special Needs and Their Families

Although the pandemic has disrupted the world, social and educational restrictions have affected children with developmental disabilities more intensely than most people. Special needs children often do better with structured daily routines, specific types of social...

Understanding Basic Terms Involved in Special Needs Care and Planning – Part I

At Rubin Law, we are proud to provide legal services exclusively limited to special needs planning including the areas of Estate Planning, Guardianship, and Probate Law for families of adults and children with special needs. In this very specific area of the law, we...

What is an ABLE Account and How Does it Work?

Often family members and close friends of people with disabilities want to contribute financial resources to help pay for their expenses. It’s no surprise that individuals with disabilities incur significant additional costs, but they cannot directly accept financial...

What is the PUNS System and Why Do You Need to Apply?

Obtaining services and benefits for a family member with disabilities can be a complex and exhausting process. You can expect a long waiting list, inconvenient agency meetings, and many forms of paperwork. In Illinois, a person with developmental disabilities...

Should My Child Claim Unemployment Benefits? Will His Government Benefits Be Affected?

Many people with special needs are not able to work at a conventional job. However, increasingly many are employed for several hours a week. Those that were working at the start of this year may have been laid-off, furloughed, or outright fired during the economic...

How Do Economic Impact Payments Affect My Child’s Government Benefits?

For families of individuals with special needs, financial planning and ongoing accounting are extremely important.To qualify for various government benefits, specific accounts must be established and maintained with strict guidelines and parameters. Illinois law and...

We Continue To Help Our Clients Plan For The Future during the COVID-19 Pandemic With Virtual Consultations

Many of the rapidly changing circumstances due to the Pandemic create unique concerns for those with special needs and their families. In particular, the Economic Impact Payments (Link) and unemployment benefits federal add-on, have raised concerns for those on means...

Zoom Instructions for Clients

Click here for full PDF for Zoom Instructions for Clients

Future Planning in Case of Your Own Special Needs or Medical Crisis

When you work on future planning for your family, including a child with special needs, you may want to consider that you may have special needs or a medical crisis at some point. Fortunately, there is a way to incorporate your potential future needs into your plan...

Is It Ever “Too Late” to Start Future Planning for Your Child?

Your child with special needs is becoming a teenager, or is about to turn 18, or is an adult living independently. No matter how old your child is now, you may wonder if it is “too late” to start future planning. It Is Rarely “Too Late” – Start Now! No matter what...

Why Your Special Needs Trust Should Be a Separate Free-Standing Document

When you decide to create a special needs trust for your child with special needs, you should ensure that the trust is prepared as a separate free-standing document. Some people think that creating SNTs in their wills or as part of a revocable trust that becomes...

Military Family and a Child with Special Needs? Tips for Future Planning

If you belong to a military family and have a child with special needs, you have some unique future planning issues to address. Since being in the military can create some uncertainty about your plans and residence, future planning is especially important to safeguard...

How Can Future Planning Help Us Meet the Resource Limits for Benefits?

Most government benefits programs have strict “resource limits” for people applying to receive benefits. If your resources exceed the limit, you will not qualify for benefits. Future planning can help families of individuals with special needs who must have government...

Which Expenses Cannot Be Paid from an ABLE Account?

If your child with special needs has an ABLE account, you may be wondering which expenses you can pay with money from the account. ABLE accounts can only fund certain expenses for their beneficiaries – you cannot use the money to pay for anything you choose. There is...

Which Expenses Cannot Be Paid from a 3rd Party Special Needs Trust?

Special needs trusts can pay some expenses for their beneficiaries without penalties. If you are a family member of a person with special needs or the trustee of an SNT, you should learn about which expenses the trust money can pay for and which it cannot. SNTs are...

Are You the Surviving Spouse? Making Changes to Your Family’s Future Plan

If your spouse passes away, you will need to make some changes to your family’s future plan. In your grief, seeing your lawyer is probably not your first priority. But changing your estate plan could save you many headaches in the future. Why Do You Need to Change...

Taking Over Care for an Older Relative with Special Needs

When you first take over care for an older relative with special needs, you will have a steep learning curve. You will need to figure out everything from benefits to estate planning for your relative. Here are a few places to start. What Is Your Relative’s Benefits...

Why to Start Future Planning When Your Child with Special Needs Is Young

Starting to future plan while your child with special needs is young could produce unexpected benefits. In addition to setting up wills and medical directives for everyone in your immediate family, you should talk to your own parents about their estates. The way they...

How Is a Guardianship Different from a Power of Attorney?

When your child with special needs turns age 18, you may lose all ability to assist with healthcare and financial decisions if you do not take a few crucial steps. At 18, the government considers your child an adult and will prevent you from accessing medical...

Future Planning When Your New Child or Stepchild Has Special Needs

If you have just welcomed a new child or stepchild who has special needs into the family, you probably have questions and need some help sorting out your new life. You are not alone – many families like yours feel overwhelmed. Of course you want to meet your child’s...

Why to Future Plan for Yourself, Not Just Your Child with Special Needs

When you have a child with special needs, there is so little time to think about the future. You are constantly busy caring for and advocating for your child. Despite your full schedule, you need to make time to do future planning for both your child and yourself....

What Is the Ligas Consent Decree? Will It Help My Child?

The Ligas Consent Degree is a legal agreement that could help your child with special needs receive community services, instead of institutional care. To best understand your child’s rights to certain services, it will be helpful to understand a little more about the...

Can You Leave a 401(k) to Your Child with Special Needs?

If you have just started a 401(k) or are doing retirement planning, your first impulse may be to leave your 401(k) money to your children. When one of your children has special needs, doing this is not a good plan. Your intentions are good, but there are better ways...

Worried About Affording Long-Term Care? How Future Planning for Your Child With Special Needs Can Help YOU Pay for Long-Term Care for Yourself

If you are thinking about buying long-term care insurance or are still on the fence, you should consider beginning future planning for your child too. Doing some future planning can help you provide for your child and pay for your own long-term care. What Is Long-Term...

What Are Medicaid HCBS Waivers? Why They Are So Important, Especially for Adults With Special Needs

If you are working on getting services for your child with special needs, you may have heard about Medicaid HCBS waivers. You may not realize how important getting an appropriate HCBS waiver is for adults with special needs. What Are Medicaid HCBS Waivers? Medicaid...

Can You Use Money from a 529 Plan to Help Your Child with Special Needs?

If you began saving money for your child’s education in a 529 plan, you probably were planning to use that money on your child’s education at some point in the future. For children with special needs, money for expenses related to their special needs may be needed...

Required “Pay Back” for Illinois ABLE Accounts: What You Need to Know

You may have heard that the state of Illinois changed the ABLE account laws to remove the required “pay back” when an account beneficiary dies. Families of people with ABLE accounts may think this change will help them. Unfortunately, the change does not apply to most...

ABLE Accounts: What’s New in 2018?

Due to new tax laws passed in 2017, individuals with special needs can make more contributions to their ABLE accounts than they could in the past. ABLE accounts are special savings accounts that have tax advantages. They can be established for people with special...

A Guardian’s Rights and Responsibilities in Illinois

In Illinois, guardians for people with special needs have specific rights and responsibilities to meet. If you have become a guardian or are considering a guardianship for your adult child, take some time to learn about what a guardian must do. Guardian of the Person...

Ending a Guardianship: How and When to Do It

When you are deciding whether to pursue guardianship for your adult child with special needs, you should learn about ending a guardianship. You may realize that since ending a guardianship is difficult, you might be better off waiting to seek one in the first place....

What Is the Illinois PUNS List, and Why Is It Important?

Trying to get services for your child with developmental disabilities can be a struggle. You face long waiting lists, reams of paperwork, inconvenient appointment times, and more. In Illinois, you need to enroll your child on the PUNS List to get priority for...

Health Insurance for Relatives with Special Needs

Families often struggle to pay for health care for their relatives with special needs. Insurance rarely covers all the costs, and the many doctors’ invoices and prescription co-pays may be overwhelming. Make sure you take advantage of all the health insurance programs...

Will a Divorce Impact Our Special Needs Trust?

When you and your spouse start talking about divorce, you should consider the effects of splitting up on your child with special needs. Divorce will require changes to your future planning, including – potentially – available benefits and your child’s special needs...

How to Gather Information to Include in a Letter of Intent

You read online or heard from your lawyer that you should write a “letter of intent” for your child with special needs. But you have no idea where to start. Your daily life is busy and sometimes chaotic, and sitting down to write a formal letter sounds overwhelming....

Do You Need to Change Your Future Planning Due to the New 2018 Tax Laws?

In January 2018, several new tax laws went into effect that could change your future planning. You should check in with the lawyer who prepared your estate plan and any documents for your child with special needs to see if it is time for an update. If you have not yet...

Top 5 Reasons to Start Future Planning Today

If you are hesitant about starting your future planning now, here are five reasons not to delay. Even if you have just learned that your child has special needs, it is never too early to make a plan. There’s No Time Like the Present Right now, your family may feel...

Future Planning for an Independent Adult with Special Needs

If your family includes an independent adult with special needs, you should do some future planning to ensure your child or other relative has everything he or she needs to continue living independently. Here are a few suggestions and options to discuss with your...

The Gift Tax and Special Needs Trusts

When you give money to a special needs trust, you may worry that you or the trust will owe the IRS money for the gift when Tax Day rolls around. Both assessing the gift tax and taxation of an SNT are very complicated topics that depend on the trust language and your...

Your Relative with Special Needs Plans to Get Married. What Next?

When you learn that your relative with special needs plans to get married, you probably have many questions about the future. Importantly, you should be concerned about whether your family member can continue to receive government benefits after marriage. If your...

Can You Leave Retirement Account Funds to a Relative with Special Needs?

If you support a relative with special needs, you may want to leave your retirement account funds to him. If this is not done correctly this can be a big problem. When you leave money or assets to a person with special needs, it could make him ineligible for...

Can You Leave Life Insurance Proceeds to a Relative with Special Needs?

You may be interested in purchasing life insurance as a way to fund your child with special needs’ future expenses. It’s fine to get a policy as long as you can afford it. But do not make the common mistake of naming your child as the beneficiary of the policy. Life...

How to Involve Your Child with Special Needs in Future Planning

When you first start future planning for your child with special needs, he or she might be too young to get involved in the many decisions you have to make. As time goes by, your child may express strong preferences about aspects of their lives, or ask questions about...

What You Need to Know Before Your Child with Special Needs Turns 18

Don’t wait until your child with special needs turns age 18 to begin planning. Becoming a legal adult leads to many changes in available benefits, needs, and your ability to act on your child’s behalf. Here are just a few of the many items for your to-do list....

Is Long-Term Care Insurance Worth It?

You may have heard about buying long-term care insurance. This insurance helps cover the costs of a care facility outside the home or even nursing care inside of your home. There are a few pros and cons of long-term care insurance that you should consider before...

Just Moved to Illinois with Your Child with Special Needs? What You Need to Know

If you have just moved to Illinois and have a child with special needs, you need to take action now to ensure your child gets vital services. You also need to make sure that your child and your family are ready for the future. PUNS In Illinois, PUNS is no laughing...

The Federal Gift Tax and People with Special Needs

You may not know that the federal gift tax could affect your future planning for your family if you have a child or other relative with special needs. First, you will need an introduction to how the gift tax works. Second, you need to know how to structure your future...

How Do SNTs Affect Beneficiaries with Special Needs’ Eligibility for Subsidized Housing?

The federal and state governments subsidize some housing under programs such as “Section 8” for people with special needs. Some people who want to apply for Section 8 have special needs trusts (SNTs) that benefit them. If you are considering Section 8, you may wonder...

Income Taxation of Special Needs Trusts, Part 2

In your future planning for your child with special needs, remember to consider income taxation of special needs trusts, including Qualified Disability Trusts (QDTs). If you set up a special needs trust (“SNT”) with another law firm, the attorneys may not have...

Trusts: The Basics

People just beginning their future planning may hear many terms thrown around by their relatives and attorneys: trust, beneficiary, settlor, and more. For those unfamiliar with trusts, the many different words used to describe them can be quite confusing. This article...

What Is a Guardian Ad Litem?

A guardian ad litem, or guardian “for the suit”, can be appointed by the court before a guardianship hearing to act in the guardianship proceeding. The court can appoint a guardian ad litem to report to the judge about the person with special needs’ best interests....

When You Have No Estate Plan: Part 2

Not having an estate plan could lead to serious consequences for your family in your absence. Future planning not only helps you move forward if you have a serious illness or if you are in need of money in the future, but also helps your family carry on without you....

When You Have No Estate Plan: Part 1

When you have no estate plan, life changes could lead to personal and financial disaster. Future planning is all about planning now to save time, trouble, stress, and money in the future. If you are on the fence about creating an estate plan, learning about the worst...

Picking the Right Professionals for Your Trust

Trustees of special needs trusts often need to pick professionals to assist with trust management and oversight. With so many licensed professionals to choose from, how does a careful trustee find the “right” professionals? Consider a few basic guidelines. How do you...

Trustee Fiduciary Duties, Part 2

Trustees have fiduciary duties to beneficiaries of trusts that they oversee. The duty to account and the duty to invest and manage trust assets prudently are two very important fiduciary duties that are difficult for many family member trustees to manage on their own...

Going to Court for the Guardianship Hearing

When you seek a guardianship for a person with special needs, you must follow many of the same formalities as in a court case. Obtaining a guardianship is a serious matter because it strips the person with special needs of the ordinary rights all other adults have....

Can a Guardian or Trustee File a Lawsuit on Behalf of an Individual with Special Needs?

An individual with special needs may need a guardian or trustee to file a lawsuit on his behalf. If it makes sense to file a lawsuit under the circumstances, the individual with special needs or relatives will need to determine if someone else is the correct person to...

My Child was Selected from the PUNS List

From the Arc of Illinois: So, You Received a Letter that Your Child was Selected from the PUNS List? If you receive a letter informing you that your child has been selected to apply for services, IMMEDIATELY contact your Independent Service Coordination Agency (ISC)....

McHenry County Electronic Filing Instructions (Guardian’s Annual Report)

mchenry.county.efiling.instructions.inventory.accounting

Lake County Electronic Filing Instructions (Guardian’s Annual Report)

lake county.efiling.instructions

Kane County Electronic Filing Instructions (Guardian’s Annual Report)

kane.county.efiling.instructions

DuPage County Electronic Filing Instructions (Guardian’s Annual Report)

dupage.county.efiling.instructions.rev

Cook County Electronic Filing Instructions (Guardian’s Annual Report)

cook.county.efiling.instructions.rev

Trustee Fiduciary Duties, Part 1

Trustees have fiduciary duties in administering trusts. These duties arise from state law, including statutes and court cases. Fiduciary duties help ensure that a trustee best manages assets for the benefit of the trust’s beneficiaries. The duty of care requires...

The Legal Procedure for Seeking Guardianship

The legal procedure for seeking guardianship of an adult with special needs in Illinois involves petitioning the court for an order appointing a guardian. Petitioners must follow court procedure exactly to receive the order. Either an “interested person” such as a...

What Is the Difference Between Medicaid and Medicare?

Despite their similar-sounding names, Medicaid and Medicare are very different programs. To understand how these programs could factor into your future planning for someone with special needs, learn about Medicaid and Medicare functions and eligibility requirements....

What Is the Difference Between SSDI and SSI?

Special needs future planning should include guidance in applying for and determining how to remain eligible for government benefits such as SSDI and SSI. If this is your first time learning about the various benefits that are available, you may be wondering what the...

Why Is Medicare Deducting Premiums from My SSDI Check, and Can the Deductions Be Avoided?

Medicare is a federal government health insurance program covering costs such as hospital charges, home health care, doctor fees, lab costs, outpatient care, and prescription drug coverage. Recipients pay premiums, deductibles, and coinsurance. For Medicare recipients...

Tax Benefits of a Qualified Disability Trust

The IRS classifies some special needs trusts as Qualified Disability Trusts, and these trusts have certain tax benefits. QDTs may claim a personal exemption on their federal income tax returns. Please note, as part of the Tax Cuts and Jobs Act of 2017 the personal...

Income Taxation of Special Needs Trusts, Part 1

In your future planning for your child with special needs, remember to consider income taxation of special needs trusts. If you set up a special needs trust (“SNT”) with another law firm, the attorneys may not have discussed how you should file taxes for that trust....

What Is a Resource? What Is Countable? Your Questions about SSI Eligibility Answered

Evaluating your countable resources is key to determining your SSI eligibility. Making this evaluation, however, can be complicated and confusing. Start by determining which items owned by you or owned by the planned SSI recipient are “resources”. A “resource” for...

Qualifying for Federal Subsidized Housing

Qualifying for federal subsidized housing can be an important step toward living independently for individuals with special needs. The federal government, through the Department of Housing and Urban Development (HUD), funds public housing for eligible people with...

Payments from Non-Special Needs Trusts to People with Special Needs

For people with special needs, receiving a payment from a non-special needs trust may have significant consequences. In fact, any unexpected payments can jeopardize a person with special needs’ eligibility for Supplemental Security Income (SSI) benefits, Medicaid, and...

New Illinois PAC Aims to Help People with Special Needs

Inclusion PAC, a new political action committee, aims to help people with special needs in Illinois. Rubin Law is excited to highlight Inclusion PAC’s formation because it is the first PAC in Illinois and one of the first in the nation with the sole purpose of...

Short-Term Guardian Declarations

A guardian of a person with special needs who will be unavailable for a short period of time should execute a short-term guardian declaration. The declaration has the effect of appointing a temporary guardian for the ward (the person with special needs) until the...

Money Management for an Adult with Special Needs

Money management for an adult with special needs is an important life skill. With the many restrictions on spending due to the SSI and Medicaid rules, learning how to spend and save money without going into debt or helping a family member to do so can be complicated....

Press Release: Brian N. Rubin Elected President of Special Needs Alliance

October 31, 2017 (Tucson, Arizona) — Brian N. Rubin, Rubin Law, A Professional Corporation, with offices in Chicago, Skokie, and Buffalo Grove, Illinois, whose law practice focuses exclusively on “special needs legal and future planning,” has been elected president of...

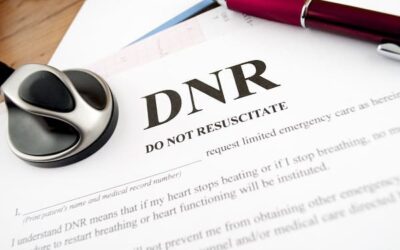

Medical Directives: Which Ones Do You Need?

Signing medical directives can be especially important for people with special needs and their family members because it may be more difficult for them to communicate their treatment wishes to doctors. The terms medical directive, power of attorney, and end-of-life...

HIPAA and Adults with Special Needs

Families of adults with special needs should become familiar with how HIPAA affects medical privacy and decision-making. HIPAA is an acronym that stands for “Health Information Portability and Accountability Act”, a federal law that governs health information privacy...

Different Definitions of “Special Needs” Under the Law

Different federal and state laws provide very different definitions of the terms “disability” or “special needs”. You may be surprised to learn that many individuals whom their families, doctors, or communities consider to have special needs are not protected by all...

How Much Money Do You Need to Fund a Special Needs Trust?

If you are thinking about forming a special needs trust, you may be wondering how much money you need to fund it. In truth, there is no way to know how much your child will need for the rest of their lifetime, nor what government benefit programs will even exist...

What Is the Illinois Health Care Surrogate Act?

For people with special needs and their families, the Illinois Health Care Surrogate Act provides much-needed peace of mind about making medical decisions if they have not yet started the future planning process. The Health Care Surrogate Act allows family members or...

Special Needs Future Planning When Future Health Care Funding Is Uncertain

Parents of children with special needs, advocates, and care providers have followed recent news about health care funding with worry, because health care funding proposals would cut Medicaid funding by 25 percent or more. While lawmakers in Washington have not passed...

Can a Person with Special Needs Under a Guardianship Still Vote?

In the United States, voting is one of the most important rights afforded to citizens. It may surprise you to learn that not every free citizen can actually exercise that right. Many people with special needs cannot vote because they have guardians, because they do...

How Can I Use Insurance to Protect My Child with Special Needs’ Future?

Protecting the future of your child with special needs requires a many-faceted approach, and insurance is only a part of it. Have you considered the role that insurance will play in your future plan? If not, now is the time to determine which insurance is best and how...

Expenditures from a Special Needs Trust

Families of individuals with special needs use special needs trusts to save for future expenses and protect eligibility for government benefits. Eventually, you or, in the case of 3rd party special needs trusts more likely the successor trustees, will need to use some...

Can a Person with Special Needs Keep His Driver’s License Even If He Has a Guardian?

Maintaining independence and stability for people with special needs strongly motivates many decisions about their lives, including the most appropriate form of transportation. People who have special needs and their families should be aware that guardianships can...

Your Non-Special Needs Children May Need Estate Plans Too

If you are working on your family’s estate plan to protect your child with special needs, be aware that your other children may need to do some future planning too. As described in a previous blog article on our website, leaving your estate to the sibling of a child...

What Is a Letter of Intent?

Advocates for people with special needs often talk about writing a “letter of intent” for your family member’s care. What exactly is a letter of intent? What should you include in your letter? Here are a few suggestions. Every letter of intent is different, so your...

Estate Planning for Your Extended Family

When estate planning for your family’s future, don’t forget that extended family members may need to change their plans too if they want to help your child with special needs. This article described some common situations that arise when well-meaning relatives want to...

Risks of Leaving Your Estate to Your Special Needs Child’s Sibling

When making your estate plan, be aware that there are substantial risks to leaving your estate to the sibling of your child with special needs. Sometimes, doing so seems like the least complicated solution – the sibling can use funds from your estate to pay for care...

Post-22 Programs Available in Illinois

Individuals with special needs living in Illinois qualify for a number of educational services and assistance until they turn age 22. As families of individuals with special needs know, these needs do not stop at age 22, but many may feel at a loss regarding which...

Learn About Pooled Special Needs Trusts

Pooled special needs trusts differ greatly from individual special needs trusts and can be a great way to gain the benefits of an SNT while reducing some of the practical downsides. Both pooled and individual SNTs have the same goal – prevent assets from affecting...

Can a Person with Special Needs Establish His Own Trust?

As of December 30, 2016, individuals with special needs who have capacity can establish their own special needs trusts. See 21st Century Cures Act, P.L. 114-255, Section 5007 (2016). Previously, first party self-settled special needs trusts could only be created with...

Types of Illinois Adult Guardianships

Illinois law permits several different types of adult guardianships. Guardianships protect people with special needs by allowing guardians to make financial, legal, and logistical decisions for them. Guardianships are supervised by the probate court, which appoints a...

Who Can Make Decisions for a Minor Child with Special Needs?

If you are in the position of making decisions for a minor with special needs, you may wonder who besides you can make these often-difficult decisions. Generally, parents are the only ones who can decide things for their children. If a child has a guardian in lieu of...

Pros and Cons of Using a Bank as a Trustee

When forming a special needs trust for your child, you may wonder whether using a bank as a trustee or other professional individual or entity is a good idea. An “institutional trustee”, which is called a corporate trustee, refers to a bank or trust company that...

What Is a Power of Attorney?

A power of attorney ensures that someone will be there to make decisions for a person when he is no longer able to make them for himself. It is a legal document specifying that a certain person or persons can take certain actions for another person. Powers of attorney...

Irrevocable Life Insurance Trusts: How They Work

Irrevocable life insurance trusts (“ILIT”) can be one part of future planning for individuals with special needs. Like other future planning methods, people planning to use an ILIT as part of their plan should learn about important provisions to include specific to...

Can an SNT Be the Beneficiary of My Retirement Account?

When determining whether you can name a special needs trust (SNT) as the beneficiary of your retirement account and accomplish your intended result, you will quickly learn that the answer is “it depends.” It depends on the type of beneficiary designation and on tax...

How a Veteran Can Leave His Military Pension to a Special Needs Trust

Under recent changes to military pension plan rules, you can leave your pension to a special needs trust for the benefit of a child with special needs. Military members may choose the Survivor Benefit Plan (SBP) option, as part of their retirement pay options. SBPs...

Our Personal Experience Drives Our Legal Practice

When our firm’s founder Brian Rubin began practicing special needs future planning, he drew on his personal experience. Brian’s son Mitchell has autism and other diagnosed special needs. He was born in 1981, and Brian has focused solely on helping Illinois families of...

Why Is Estate Planning for People with Special Needs Different?

There are a number of reasons why estate planning for people with special needs can be different than planning for people who do not have special needs. Understanding these reasons will help you during the initial planning process and beyond. You should think of these...

Why Our Firm Only Practices in the Area of Special Needs Planning

From our personal experience, we know that families who are planning for their special needs relatives’ futures need strong advocates to advise them. Brian Rubin began to dedicate his legal practice to special needs planning after the birth of his son Mitchell, who...

When should I set up and fund my child’s special needs trust?

A special needs trust can be the most important savings account your child with special needs will ever have. It should be set up as soon as you know that your child has special needs, and funded through ways that will help keep future government benefits in place....

Special provisions needed in your will, living trust and power of attorney, when you have a child with special needs

If you have children, you should have an estate plan in place. This is especially true for parents of a child with special needs. An estate plan that includes a will, living trust, powers of attorney and other provisions can help protect your child with special needs...

Alternatives to adult guardianship

Families of a child with special needs must often consider adult guardianship. It’s defined as a legal proceeding in which someone, often a parent, sibling or other family member, asks the Illinois court to find that a person is unable to manage his or her affairs...

What a personal injury attorney needs to know about representing a child or adult with special needs

Personal injury attorneys should work very closely and carefully with their clients who have a child or adult child with special needs to ensure a plan is put into place that benefits the person for the rest of their lives. Otherwise, the settlement from a personal...

Can I leave my teacher’s TRS pension to my child with special needs?

Illinois lawmakers set up the Teachers’ Retirement System, or TRS, in 1939. It is a pension program designed to provide retirement annuities, disability benefits and survivor benefits for men and women who work in the state’s public schools. If you are a teacher in...

Should I ask one of my other children to be the trustee for my child with special needs?

Choosing a trustee to oversee a trust for your child with special needs can be difficult. Just as the name implies, you should look for someone you can trust. That’s why many parents opt to ask another adult child to be the trustee for a special needs’ trust that has...

Can I leave my SURS pension to my child with special needs?

No parents of a child with special needs want their son or daughter to be forced to rely solely on public assistance programs like Social Security disability, Supplemental Security and Medicaid to survive. So, they often look at their options for taking care of the...

How do I put money into my child’s special needs trust?

A third party special needs trust is an important tool in long-term planning for a child with special needs. A special needs trust can help parents plan and maintain the child’s financial stability while ensuring his or her long-term eligibility for government...

Choosing a residential program for your child with special needs